are hearing aids tax deductible in 2020

Only medically required equipment is eligible to be deducted. If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct expenses you paid that year for medical and dental care for yourself your spouse and your dependents.

Hearing Aid Blog Hearing Loss Articles Earpros

The good news is that if you have an income and pay income tax you can claim a tax offset for any out-of-pocket costs on your hearing aids.

. Depending on the type of hearing aid they may cost anywhere from 1000 to 4000 per ear. Also it is important to keep in mind that you can only claim the expense amount that is not going to be reimbursed by insurance or covered by a warranty. For tax deductible hearing aids consider the following costs.

In other words as we understand it. Oes that are tax deductible include. Hearing aids like most medical expenses are sometimes tax-deductible reducing the overall outlay.

Summary The IRS is the largest. You can only deduct medical expenses if you itemize your deductions. Due to their ease of use deafness relief is extremely effective for treating sensorineural hearing loss which there is no cure for.

Its estimated one million accountants are hired each. The standard deductions for 2019 are. The high cost of hearing aids can mean that millions of Americans avoid buying a hearing device because they can.

They can only deduct the amount of their medical and dental expenses that is greater than 75 of their adjusted gross income. Are hearing aids tax deductible in 2020. Single - 12200 add 1650 if age 65 or older add.

Expenses related to hearing aids are tax deductible. According to Health Hearing and other sources we consulted the following applies to hearing aid deductibles for the 2020 tax season. And for those who require hearing devices economics shouldnt be a barrier to hearing health.

In January 2017 S48 the Hearing Aid Assistance Tax Credit Act was introduced to Congress. The bill was read twice before being referred to the Committee on Finance where it later failed. June 3 2019 1222 PM.

A battery to power hearing aids. Deductions can only be claimed if your total out-of-pocket health costs are more than 10 of your adjusted gross income. Are hearing aids tax deductible in 2020.

Original Medicare does not cover hearing aids at all but some Medicare Advantage plans may cover some or all costs relating to hearing aids. Tax offsets are means-tested for people on a higher income. They come under the category of medical expenses.

For goods and services not required or used other than incidentally in your personal activities. NexGen Hearing is here to help you understand whether or not hearing aids are tax-deductible in Canada. By Mar 24 2022 how to become popular cosplayer modulr fs limited revolut.

Donate your Hearing Aids - Tax Deduction TipHealthy hearing should be enjoyed by all citizens. If you are over 65 years of age this drops to 75. The legislation has not been reintroduced.

This includes people earning 84000 as a single person or. The Hearing Aid Donation Center a project of Hearing Charities of America begins the process of recycling hearing aids for those in needThrough the generosity of. Even with insurance the cost of hearing aids will vary.

In spite of this a new tax law allows taxpayers to deduct up to 8000 for health care expenses. What Medical Expenses Are Tax-Deductible 2020. As of mid-2020 there are no tax credits for hearing aids.

The IRS is the largest accounting and tax-collection organization in the world with in excess of 480 forms posted on their website and more employees than the FBI. 502 Medical and Dental Expenses. At Least Hearing Aids Are Partly Tax Deductible.

They can only deduct the amount of their medical and dental expenses that is greater than 75 of their adjusted gross income. If you use the standard deduction you cannot deduct any medical expenses. The hearing aids are medical expenses and not employee business expenses.

When you itemize your deductions make. Medical expenses that exceed 7 percent of a taxable income cannot be deducted as an expense. Impairment-related work expenses are ordinary and necessary business expenses that are.

Some medical expenses require certain. Hearing aids can be tax deductible in many cases. As much as 35 percent more money can be saved by deducing hearing aid prices from your taxable income.

In the next two years they will receive 5 of their income. Anything bought or paid for in 2020. You may deduct only the amount of your total medical expenses that exceed 7.

As of mid-2020 there are no tax credits for hearing aids. By deducting the cost of hearing aids from their taxable income wearers could reduce the cost of their hearing aids by up to 35. March 16 2020 311 PM.

For the IRS to recognize your hearing aid tax credit you must ensure your deductions are itemized when you complete your tax return. Income tax rebate for hearing aids.

At What Age Do Most People Start Needing Hearing Aids

Starkey Hearing Technologies Review

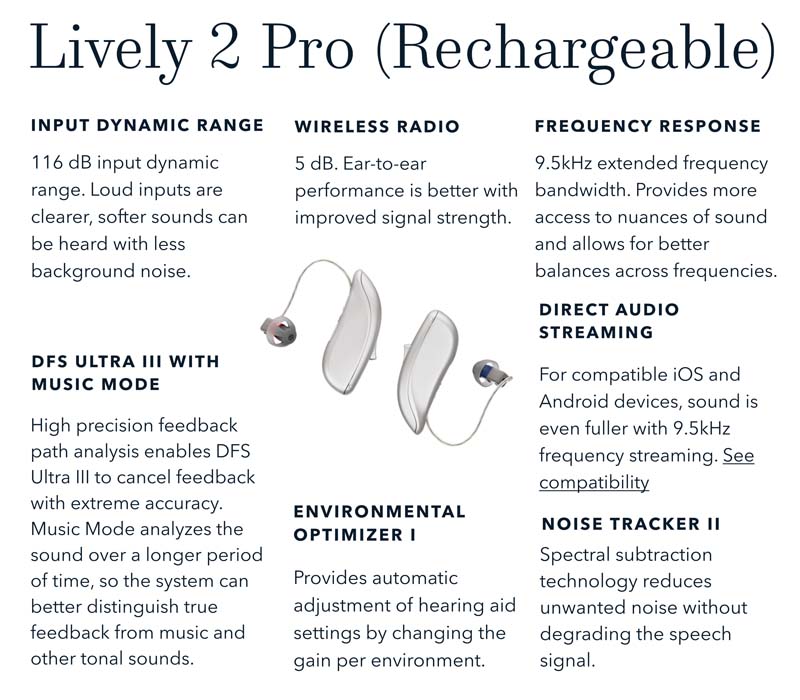

Lively Hearing Aids Reviews With Costs Retirement Living

Are Hearing Aids Tax Deductible In Canada Nexgen Hearing Clinics

Are Hearing Aids Tax Deductible In Canada Nexgen Hearing Clinics

Are Hearing Aids Tax Deductible Sound Relief Hearing Center

How Much Do Hearing Aids Cost Find Answers Here

How Much Are Hearing Aid Costs In Canada

Are Over The Counter Hearing Aids On The Way Lsh

Community Hearing Aid Programs Jacksonville Speech And Hearing Center

Costco Hearing Aids 5 Things To Know Before You Buy

How To Pay For Hearing Aids Retirement Living 2022

Over The Counter Hearing Aid Regulations Jacksonville Speech And Hearing Center

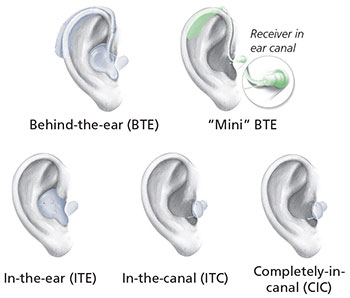

Types Of Hearing Loss Treatment And Hearing Aids In Canada